Canada T3010 E 2020-2024 free printable template

Get, Create, Make and Sign

Editing t3010 form online

Canada T3010 E Form Versions

How to fill out t3010 form 2020-2024

How to fill out t3010:

Who needs t3010:

Video instructions and help with filling out and completing t3010 form

Instructions and Help about charity return cra form

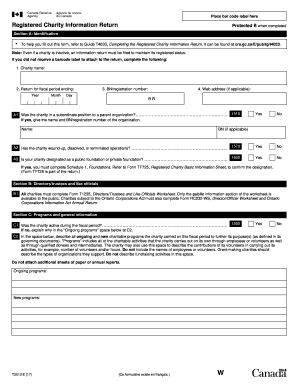

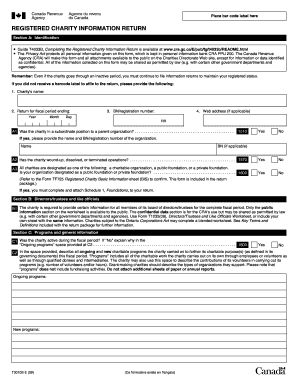

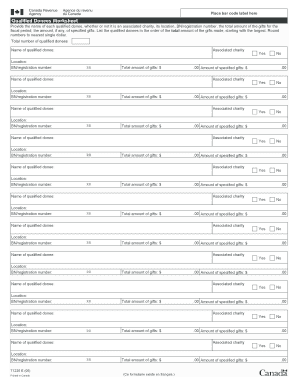

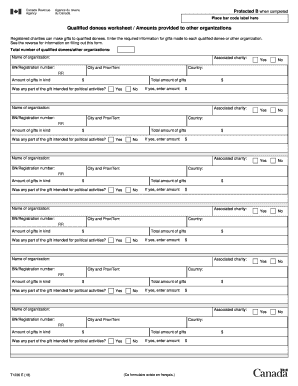

Hello my name is Doug Davis and I have been asked by Terry Hudson to give an update and some information on how to fill our t thirty ten charitable return for this year there has been a couple updates and one update is effective November 2018 where Canada Revenue Agency is no longer going to provide peel-and-stick barcode labels you will continue to receive the form TF 725 in your package, and you should include this form with your T 30 10 terrible information return even if there are no changes and another update and as of June 2019 you can now read through your t 30 10 filing online, and you can check this link here to see how to do that and as important information in order to pull this page up you go to your search engine and just type in T 30 10, and then you can have all this information what is needed to complete a return of course you need your T 30 10 which we'll be reviewing in another session as mentioned before the TF 725 which you receive in your package you also need of the form T 12 35 for the directors trustees we will look at that in a few minutes and then form T 12 36 which is qualified done BS, and we'll explain that in a moment as well we do not need the t 2081, and again I have a list of what financial statements you must include in your package here's the charitable return 2019 again you get this online, and you can have it with the automatic fill out, or you can fill it out by hand we're going to go into the detail of this in another video but up here is where you find that you get the guide to help you explain how to fill this form out it is a 10-page form, so you really should review to the guide as we discussed the director trustees form is basically a list of your trustees and new directors and your board members, and you fill that out and with all the information complete, and you send that in with your form qualified done BS what is qualified done BS well for instance if you give two to wives you give to Canadian food grains banks you give the national compassionate ministries you will use the name of the organization is Church of Nazarene in Canada you will need their business number, and you fill out how much it's an Associated chair to be a new total gifts you've sent to them and another one that is very common is church and Nazarene and Ontario this is where you pay your district budgets this is where your donations to cubicles again you need their business numbers and that they are an associate member you've got to not say that you're sending money to Cuba, or you're sending money to Bennett Bangladesh or anything because that will complicate your return, and it is they ordered the organizations we are donating to is Church of Nazarene Canada and church and Nazarene in Ontario the last area to cover in this video is what is required to send in for your financials statements to support your tea 3010 Music it's very simple I'll scroll down what you really need is to show your balance sheet and your income...

Fill t3010 printable form : Try Risk Free

People Also Ask about t3010 form

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your t3010 form 2020-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.